#STORIES ABOUT J WELLES WILDER SOFTWARE#

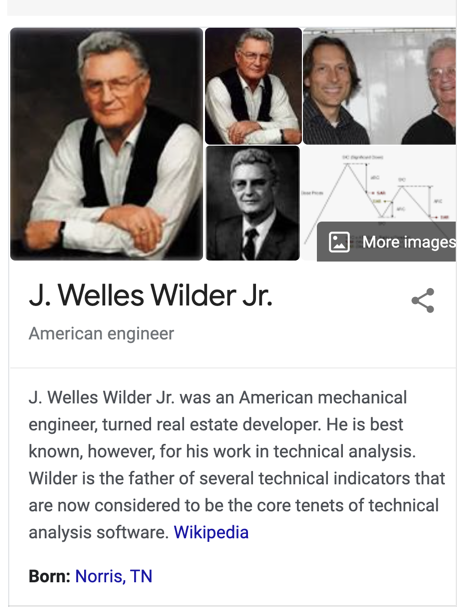

He is the father of several technical indicators that are now considered to be core indicators in technical analysis software his most famous being the RSI. is well known for his contributions to technical analysis.

As compared to a bottom-up approach, our top-down model examines the macroeconomic factors that affect the industry/economy before zooming in to Solana specific price patterns or momentum indicators. We all know the story about Welles Wilder and the relative strength index (RSI).

#STORIES ABOUT J WELLES WILDER DRIVERS#

By analyzing Solana's financials, daily price indicators, and related drivers such as dividends, momentum ratios, and various types of growth rates, we attempt to find the most accurate representation of Solana's intrinsic value. in addition, Wilder made several appearances on radio and television programs, and conducted technical trading seminars in Asia, Australia, Canada, USA, and Europe. In general, a bottom-up approach, as applied to this cryptocurrency, focuses on Solana stock first instead of the macroeconomic environment surrounding Solana. Welles Wilder, Jr., also published The Adam Theory of Markets or What Matters is Profit in 1987 and The Delta Phenomenon in 1991, as well as several articles on trading. We use both bottom-up as well as top-down valuation methodologies to arrive at the intrinsic value of Solana based on its technical analysis. But, with our Elliott wave analysis pointing to a very mature high degree fifth wave in the global stock market, the existence of bearish divergence on a weekly RSI is supporting evidence that things could be about to get much, much Wilder.The technical analysis module can be used to analyzes prices, returns, volume, basic money flow, and other market information and help investors to determine the real value of Solana on a daily or weekly bases. And then you have Welles walking into the thing going, OK let’s turn the whole expletive thing on its ear, Fincher said. Put the joy of great stories at their fingertips. Argumentative Essay Admission/Application Essay Annotated Bibliography Article Assignment Book Report/Review Case Study Capstone Project Business Plan Coursework Dissertation Dissertation Chapter. New Concepts in Technical Trading Systems Hardcover 1978 (Author) J. There was also bearish divergence like this, albeit briefly, just before the crash in 2020.Įxperienced technical analysts know that you must place every indicator in context, especially with where we are in the Elliott wave pattern. He talked about the silent era, John Huston and Billy Wilder. Reflections On The Liberation Of AnimalsAnthony J. This is a sign that underlying strength in the trend has been waning. The chart below shows that the global stock market has been making new highs this year, but the RSI remains below its January high, using a weekly time frame. Perhaps it is appropriate, therefore, that right now there could be such a signal in the global stock market, after it has experienced such a wildly bullish trend. Observing when the RSI and the underlying price diverge can signal trend exhaustion and a potential turning point.

It is then that the secret value in the RSI is revealed. The realization soon dawns, though, that these terms are meaningless when said newbies witness a market remaining "overbought" or "oversold" for long periods when there is a strong trend. Newbies to technical analysis fall in love with the RSI because it appears to tell them when something is "overbought" or "oversold".

The RSI is displayed as an oscillator between values of 0 to 100. The RSI is a momentum indicator that measures the magnitude of recent price changes (the ratio of higher closes to lower closes) to evaluate overbought or oversold conditions in the price of a stock or other asset. However, it is the venerable Relative Strength Index (RSI) that Wilder will perhaps best be known for. These include Average True Range, Average Directional Index, and the Parabolic SAR (Stop and Reverse). He created several technical indicators that have stood the test of time and are now considered to be core in any technical analysis software. Formerly a mechanical engineer and real estate developer, Wilder turned his skills to technical market analysis, publishing "New Concepts in Technical Trading Systems" in 1978. Welles Wilder Jr., who died in April aged 85. in 1978 in his book 'New Concepts in: Technical Trading Systems'. The global technical analysis is mourning the loss of one of its true giants, J.

0 kommentar(er)

0 kommentar(er)